jersey city property tax rates

Certified October 1 2021 for use in Tax Year 2022 As amended by the. Overview of New Jersey Taxes.

10 Quick Money Hacks To Boost Your Retirement Savings In 2022 In 2022 Saving For Retirement Quick Money Hacks Money Tips

Click here for a map with more tax information.

. 11 rows City of Jersey City. Table of Equalized Valuations. We had placed a call to the property tax administrator who had provided the updated rate of 161.

The 148 number is from 2018 and even Jersey Citys own website hasnt been updated to reflect the change. New Jersey has one of the highest average property tax rates in the country with only states levying higher property. Eduardo CToloza CTA City Assessor.

14502 00011 Principal. The New Jersey sales tax rate is currently. 6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 1 252 31 252 51 252 227 252 5677 252.

All real property is assessed according to the same standard of value except for qualified agricultural or horticultural land. Description The office of the City Assessor shall be charged with the duty of assessing real property for the purpose of general taxation. 201 547 5132 Phone 201 547 4949 Fax The City of Jersey City Tax Assessors Office is located in Jersey City New Jersey.

Online Inquiry Payment. New Jerseys real property tax is an ad valorem tax or a tax according to value. In the very near future it will be over 2.

City of Jersey City. Jersey City New Jersey 07302. Find New Jersey Tax Records Fast.

The minimum combined 2022 sales tax rate for Jersey City New Jersey is. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Visit Our Website Today.

Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. 2021 New Jersey Property Tax Rates Average Tax Bills and Assessed Home Values. Thank you for confirming.

Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. It is equal to 10 per 1000 of the propertys taxable value. Online Inquiry Payment.

Camden County has the highest property. Summits school tax rate is 094 and Summit. Get driving directions to this office.

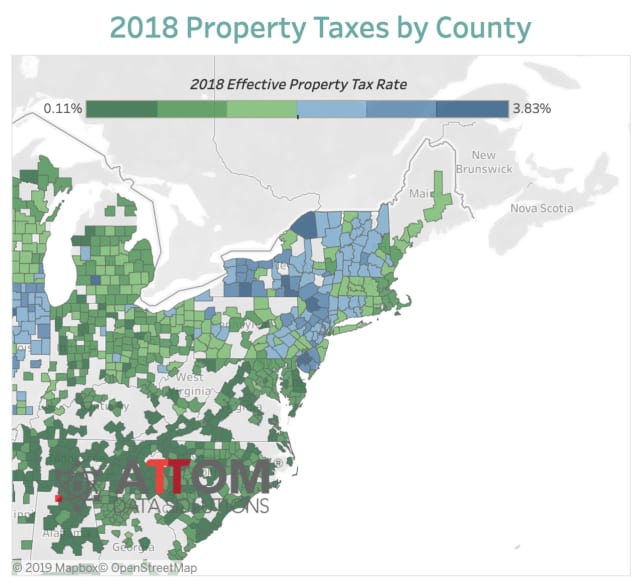

The standard measure of property value is true value or market value that is what a willing. Property income also includes any lump sums that are paid to you in connection with granting a tenancy. The average effective property tax rate in New Jersey is 242 compared to the national average of 107.

Homeowners in New Jersey pay the highest property taxes of any state in the country. Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving disagreements. If youre non-resident for Jersey tax purposes youll pay tax on any profit from Jersey property income at 20.

The County sales tax rate is. 2021 Table of Equalized Valuations for all of New Jersey. General Property Tax Information.

23 rows The Average Effective Property Tax Rate in NJ is 274. 280 GROVE ST Bank Code. The remaining 63 of the property tax goes to the county and city.

TAXES BILL 000 000 000 0 000. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. Real estate evaluations are undertaken by the county.

Tax amount varies by county. Jersey City establishes tax levies all within the states statutory rules. In fact rates in some areas are more than double the national average.

The General Tax Rate is used to calculate the tax assessed on a property. The Jersey City sales tax rate is. Jersey Citys 2021 school tax rate was 052 and Jersey City sent 37 of their property tax dollars to the schools.

General Tax Rate Average Tax Bill Average Residential Assessment. New Jersey Tax Court on January 31 2022 for use in Tax Year 2022. This is the total of state county and city sales tax rates.

City Hall 280 Grove Street Room 116 Jersey City NJ 07302 Tel.

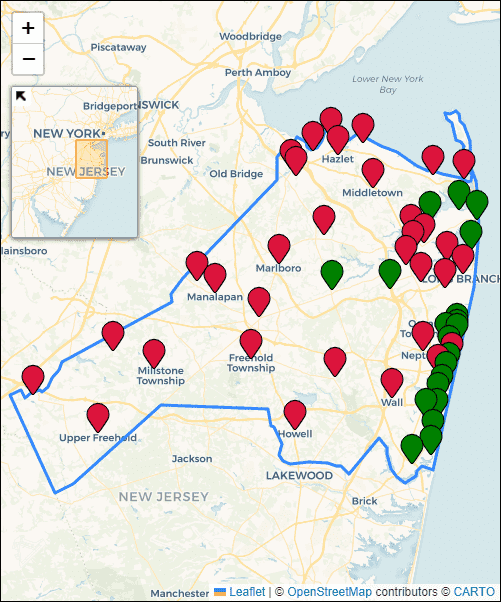

Property Tax Rates Average Tax Bills And Home Assessments For Monmouth County New Jersey

2022 Property Taxes By State Report Propertyshark

Map State Sales Taxes And Clothing Exemptions Tax Foundation

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

States With The Highest And Lowest Property Taxes

Monday Map State Local Property Tax Collections Per Capita Tax Foundation

Property Tax Abatements How Do They Work

Riverside County Ca Property Tax Calculator Smartasset

These Hudson Valley Counties Have Highest Property Tax Rates In Nation New Study Says Ramapo Daily Voice

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

New York Property Tax Calculator 2020 Empire Center For Public Policy

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Nyc Home Prices Plunge After Salt Deductions Capped

Colorado S Low Property Taxes Colorado Fiscal Institute

Pursuing A Property Tax Appeal In New Jersey Sharlin Law

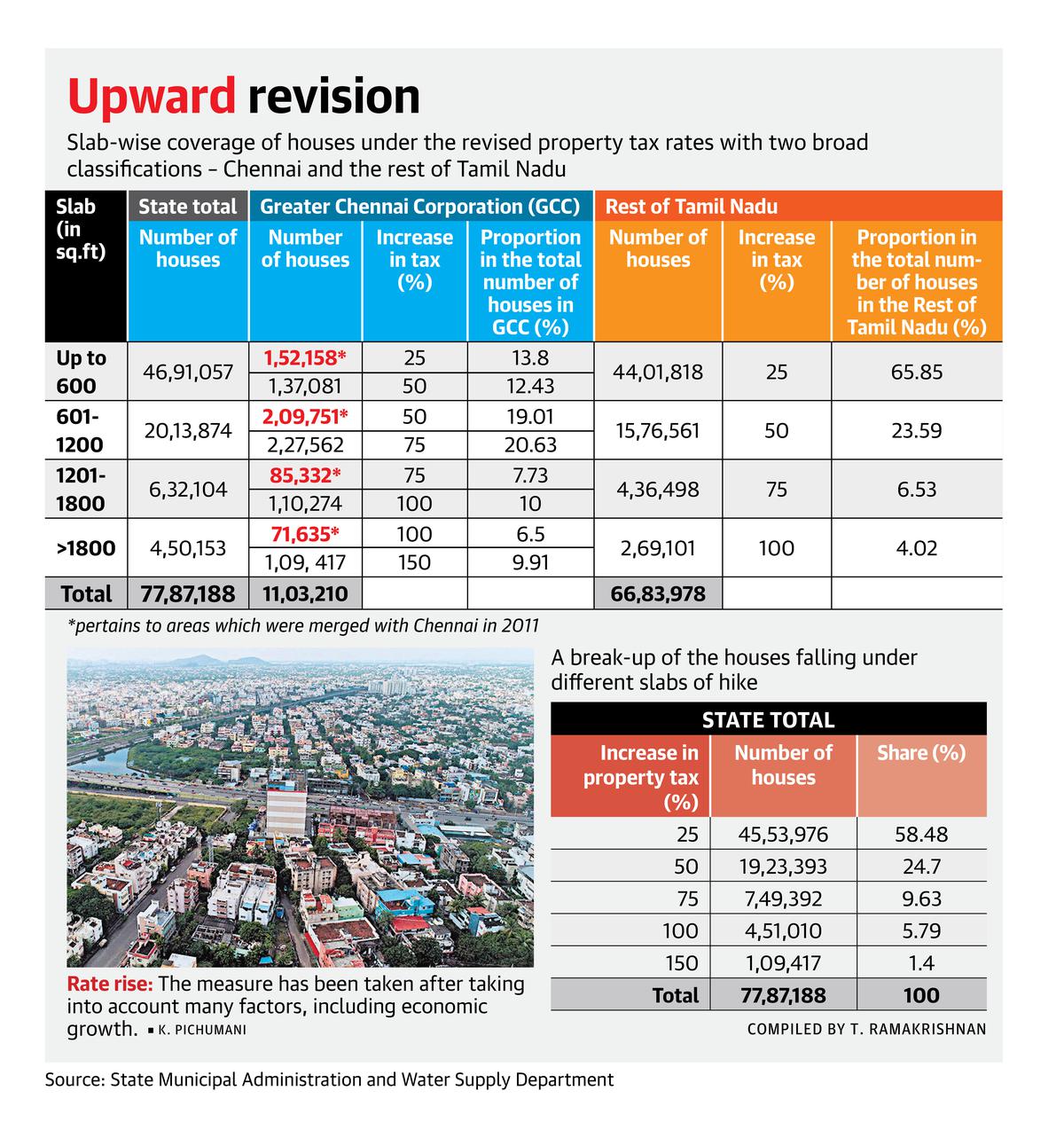

Tamil Nadu Property Tax Hike 25 50 Hike Covers About 83 Of Houses The Hindu

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future